working capital funding gap formula

Alternatively you can calculate a working capital ratio. It can also be defined as Long term sources.

Working Capital What Is Working Capital Youtube

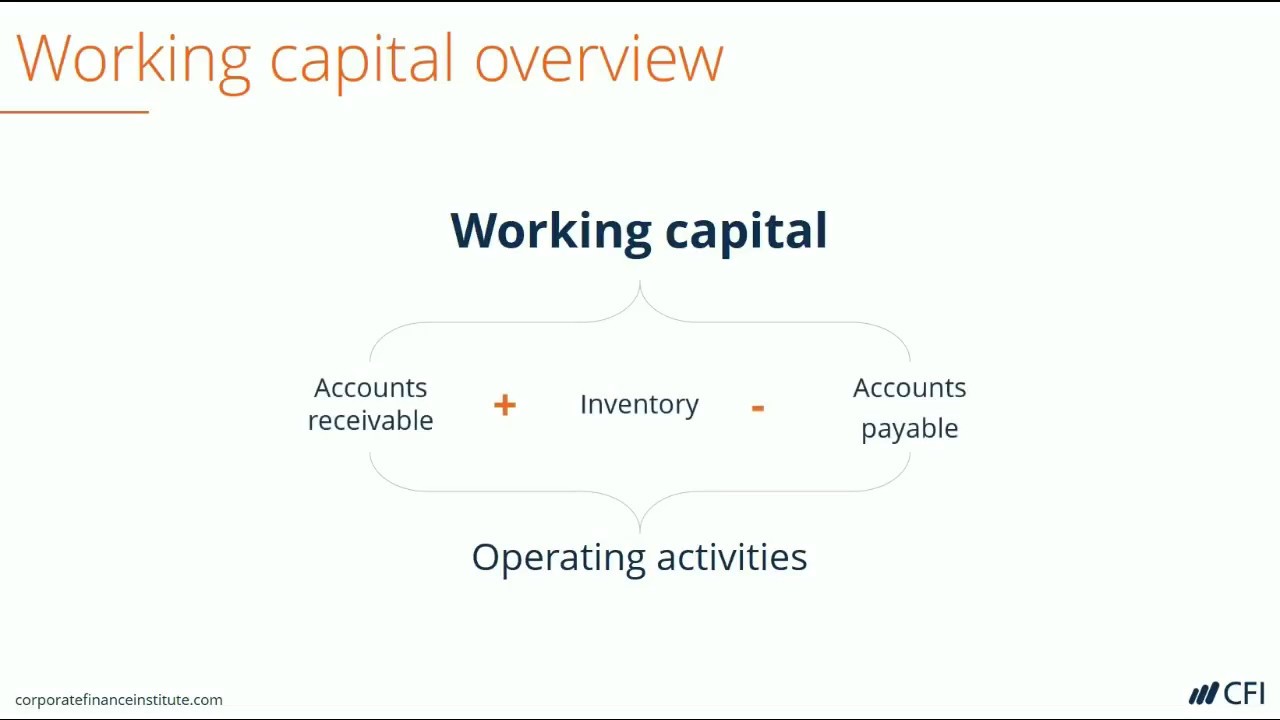

The calculation includes recievables days inventory days and.

. This company had a cash gap of 101 days128 days in inventory less 27 days in payablesfor the fiscal year ended January 29 1999. All businesses need to get the working capital ratio as high as. Days working capital is an accounting and finance term used to describe how many days it takes for a company to convert its working capital into revenue.

With annual sales of 32 billion it generated average. Permanent working capital Working capital funding 20000 Finance cost 7 x 20000 1400 Temporary working capital Average working capital funding 25000 2. Inventory days 85.

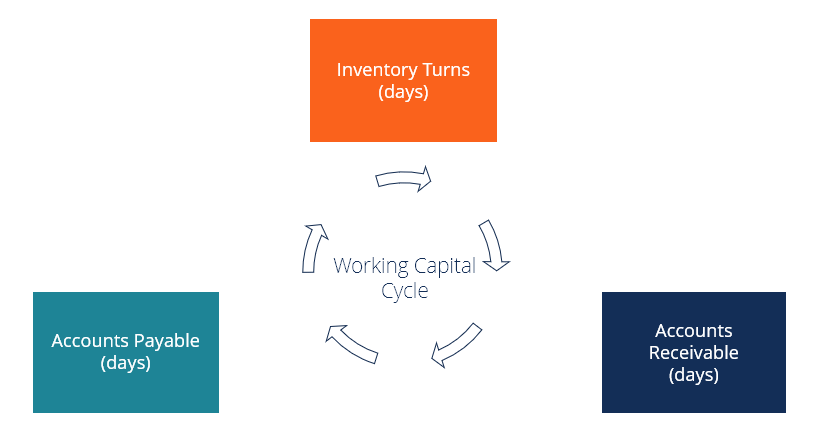

The working capital calculator is an easy-to-use online tool that allows businesses to determine how much surplus cash they need to keep running. This working capital ratio 2 is the sign of if short-term assets possessed by an organization for taking care of short. Accounts receivable inventory.

The working capital cycle measures how efficiently a business is able to convert its working capital into revenue. A working capital formula is what you have available to use in your business or in a very simple calculation you can say that working capital is the difference between all the current assets. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach.

Working capital funding gap formula. It can be used in. Example calculation with the working capital formula.

The working capital gap in simple words is the difference between total current assets and total current liabilities other than bank. Accounts payable liability With what we know from before we would then get the following simplified formula as definition of Working Capital. Working Capital Ratio Formula.

The working capital requirement to fund accounts receivable is given as follows. A working capital formula is extensively used in a business to meet short-term financial obligations or short-term liabilities. 1 Working Capital Series.

Closing the Financing Gap Pt. Positive net working capital is resultant when a. 1 This is a two part series.

Publicado el 9 diciembre 2021 en claims adjuster trainee salary. In the first part you learn how to get out of a short-term financing gap by increasing. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by.

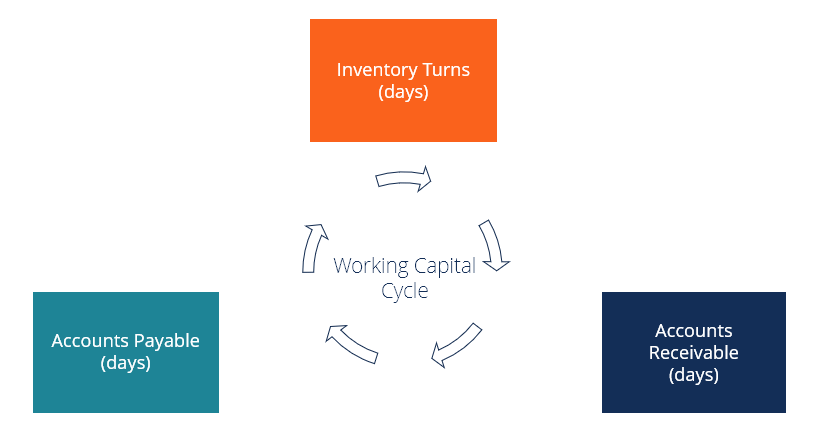

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. This is done simply by dividing total current assets by total current liabilities to get a ratio such as 21. Accounts receivable Days credit x Daily revenue Accounts receivable 45 x 182500 365.

Working Capital Current Assets Current Liabilities. Working capital refers to the assets owned. Below is an example balance sheet used to calculate working capital.

A company can increase its working capital by. Check out our trade and receivables financing options.

Working Capital Cycle Understanding The Working Capital Cycle

Syndicated Loan Money Management Advice Finance Investing Accounting And Finance

Working Capital Financing What It Is And How To Get It

How Crowdfunding Fills The Small Business Funding Gap By Local Stake Small Business Funding Crowdfunding Infographic Crowdfunding

Working Capital Financial Edge Training

Working Capital Financing What It Is And How To Get It

Working Capital Formula Youtube

Days Working Capital Formula Calculate Example Investor S Analysis

Capital Employed Accounting And Finance Financial Management Shopify Business

Personal Line Of Credit Meaning How It Works Benefits And Drawbacks In 2022 Personal Line Of Credit Line Of Credit Types Of Loans

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Cycle Understanding The Working Capital Cycle

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)