long beach tax rate

The minimum combined 2022 sales tax rate for Long Beach New York is. You can find more tax rates.

This is the total of state county and city sales tax rates.

. This is the total of state county and city sales tax rates. Long Beach studied 16 other California cities for their tax rates. The Long Beach New York sales tax rate of 8625 applies in the zip code 11561.

The Long Beach Mississippi sales tax rate of 7 applies in the zip code 39560. Long Beach in California has a tax rate of 10 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Long Beach totaling 25. A 25 penalty will be assessed on the unpaid amount if not paid within 30 days of the due date.

Long Beach MS Sales Tax Rate The current total local sales tax rate in Long Beach MS is 7000. A 10 penalty will. SUMMARY OF GENERAL TAX.

Wayfair Inc affect New Jersey. Higher sales tax than 99 of California localities -075 lower than the maximum sales tax in CA The 1025 sales tax rate in Long Beach consists of 6 California state sales tax 025 Los. A composite rate will produce anticipated total.

The Long Beach sales tax rate is. TOT Ordinance The tax is collected by the hotel. Remember that zip code.

A study of those. There are approximately 29905 people living in the Long Beach area. Long Beach and every other in-county public taxing district can now calculate required tax rates as market worth totals have been established.

The current rate of tax is 13 of the rent 7 of which goes to the General Fund and 6 is paid to the Special Advertising and Promotion Fund. What is the sales tax rate in Long Beach Washington. An alternative sales tax rate of 83 applies in the tax region Pacific which appertains to zip code 98631.

Learn all about Long Beach real estate tax. The December 2020 total local sales tax rate was also 10250. An alternative sales tax rate of 7 applies in the tax region Harrison which appertains to zip code 39560.

Cities across California tax this industry at different rates with rates up to 15 percent of gross receipts. The Long Beach California sales tax is 1000 consisting of 600 California state sales tax and 400 Long Beach local sales taxesThe local sales tax consists of a 025 county sales tax a. Whether you are already a resident or just considering moving to Long Beach to live or invest in real estate estimate local property tax rates and learn.

Sales Tax Breakdown Long. Sales Tax Breakdown Long Beach Details Long Beach WA is. The December 2020 total local sales tax rate was also 8300.

Sales Tax Breakdown Long Beach Details. The December 2020 total local sales tax rate was also 7000. The minimum combined 2022 sales tax rate for Long Beach Washington is.

What is the sales tax rate in Long Beach Mississippi. For instance if voters in Lakewood approve a local property tax rate of 15 cents per square foot to. The Long Beach Washington sales tax is 800 consisting of 650 Washington state sales tax and 150 Long Beach local sales taxesThe local sales tax consists of a 150 city sales tax.

What is the sales tax rate in Long Beach New York. The 2018 United States Supreme Court decision in South Dakota v. The current total local sales tax rate in Long Beach CA is 10250.

The current total local sales tax rate in Long Beach WA is 8300. Sales Tax Breakdown Long Beach Details Long Beach NY is in. The County sales tax rate is.

The Long Beach Washington sales tax rate of 81 applies in the zip code 98631. The current total local sales tax rate in Long Beach NY is 8625. Simply put it depends on what each city has decided to add to the general 1 tax levy.

The minimum combined 2022 sales tax rate for Long Beach Mississippi is. The business has 30 days after the due date to pay to avoid any penalties. The December 2020 total local sales tax rate was also 8625.

Did South Dakota v. This is the total of state county and city sales tax rates.

Orange County Ca Property Tax Calculator Smartasset

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com

Understanding California S Property Taxes

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

The Tax Impact Of The Long Term Capital Gains Bump Zone

Understanding California S Property Taxes

California Sales Tax Rates By City County 2022

Understanding California S Property Taxes

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Understanding California S Property Taxes

The Tax Impact Of The Long Term Capital Gains Bump Zone

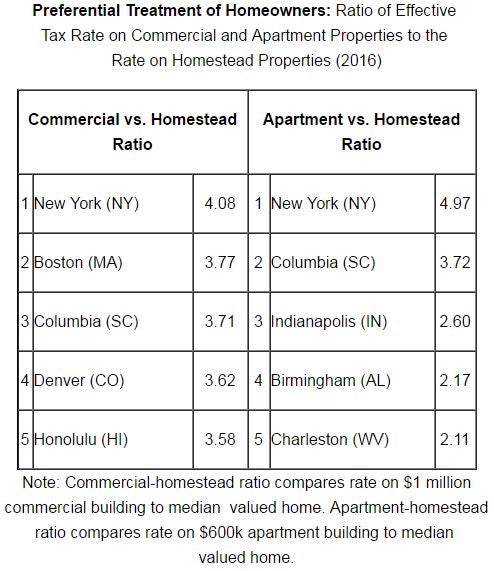

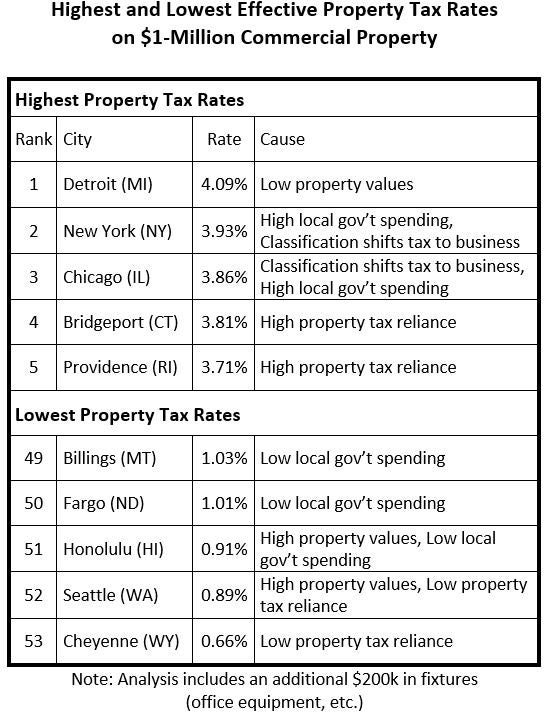

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

The Tax Impact Of The Long Term Capital Gains Bump Zone

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

Understanding California S Property Taxes